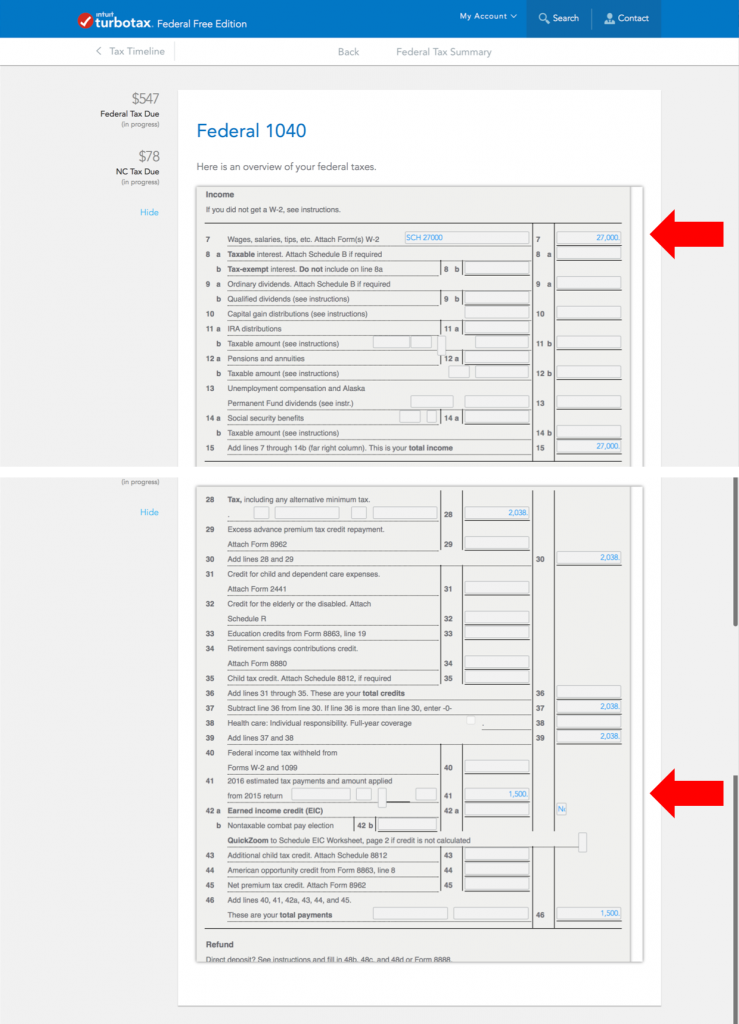

Last year the credit was $2000 of which only $1400 could be refunded after taxes were paid down. that advance was probably not the best thing to happen. let me see if I can shed some light on this situation that many folks will find themselves in this year. But this year all of the CTC is reported in the payment section but it still must be used to pay off the tax bill before anything can be. On the 2020 return the CTC is first used as a non refundable credit to pay down your tax bill and any unused is reported in the payments section and added to your refund. Compare the 2020 against the 2021 return and not the difference the placement of the CTC is this year in the flow. stop looking at the summary comparison & the refund meter and review the actual tax return. This way you will be able to tell which step (if either) is incorrectly being reported on line 28 of the Federal 1040. Review line 28 of the Federal 1040 to see whether you have been given credit for the proper amount. Then report the Advance Child Tax Credit payments received and reported on your IRS Letter 6419. You are able to view the Child Tax Credit on line 28 of the Federal 1040 under Tax Tools / Tools / View Tax Summary / Preview my 1040 after each step.Įnter the information to generate the Child Tax Credit, then review line 28 of the Federal 1040 to see whether you have been given credit for the proper amount. Second, the benefit of the credit is reduced by the amount of any advance payments reported under Federal / Deductions & Credits / Your tax breaks / Advance payments, Child and Other Dependent Tax Credits at the screen Tell us about any Advance Child Tax Credit payments.

Turbotax advance payments received full#

The IRS is sending out letter 6419 to you. And you cannot take it seriously until you enter ALL of your information-even though it is so tempting to believe that the highest amount is the "right" refund. That "refund monitor" changes as you enter information.

Turbotax advance payments received software#

That “refund monitor” should not be taken seriously until every last morsel of your data has been "refund monitor" starts off by giving your all of the stimulus money and all of the child tax credit because the software does not know yet that you received stimulus money or that you received some advance child tax credit payments. (Such as in some cases where the wrong parent got the advance payments, etc.) If you received the advance payment and are NOT eligible to get the other half, then it will not show up on line 28. You got some of it already-now you get the rest.

Don’t get confused by the reconciled amount. You are NOT losing any of the credit you are not being taxed on the credit. When you enter the amounts from your letter, the software reconciles the amount you received with the amount you can still get IF you are eligible to get the other half. NOTE: The CTC is indeed a “credit” that can be applied toward any tax liability that you would otherwise have to pay as “tax due” to the IRS.Īnd….Ignore that “refund monitor.” The software STARTS OFF by giving you the full amount of CTC.

Click on Preview my 1040 on the left side of the screen. The remaining amount of CTC that you can receive will show up on line 28 of your 2021 Form 1040.Ĭlick on Tax Tools on the left side of the screen. Federal>Deductions and Credits>You and Your Family>Child Tax Credit

0 kommentar(er)

0 kommentar(er)